Tonic Dual Pricing

Introduction

Purpose of the Guide

Welcome to the comprehensive guide on Dual Pricing. Adopting innovative pricing strategies is crucial for maintaining profitability and ensuring customer satisfaction in today’s competitive environment. This guide is meticulously crafted to demystify dual pricing, offering you an in-depth understanding of its mechanisms, benefits, and legal implications. Whether you are considering the adoption of dual pricing or seeking to refine your existing program, this guide aims to equip you with the knowledge and tools necessary to navigate the complexities of dual pricing with confidence and compliance.

Overview of Dual Pricing

Dual pricing allows merchants to manage varying costs associated with different payment methods, such as cash, credit, or debit transactions, incentivizing customers to choose lower-cost payment options. By implementing a dual pricing strategy, businesses can effectively manage transaction fees, encourage preferred payment behaviors, and potentially pass savings onto customers, all while maintaining transparency and compliance with regulatory standards. This approach not only enhances customer choice but also supports merchants in optimizing their revenue model in a competitive marketplace.

Dual Pricing Explained

Definition of dual pricing

Simply put, a dual pricing program provides customers with two different prices for a product or service based on the payment method used by the customer. Typically, this involves offering a lower price for cash transactions and a higher price for non-cash transactions, such as credit card payments. The rationale behind dual pricing is to cover the additional costs associated with processing non-cash payments, including transaction fees imposed by credit card companies and banks.

How dual pricing works

In practice, dual pricing is implemented by clearly displaying both cash and card prices to customers before the point of sale. For example, a product might be listed with a cash price of $95 and a credit card price of $100. The dual pricing model allows merchants to incentivize cash payments, which can reduce the merchant’s costs associated with card payment fees. It requires transparent communication to ensure customers understand the price difference and the reasons behind it.

Comparison with traditional pricing models

Tiered pricing, interchange-plus, and flat rate models each have distinct approaches to processing payment costs for merchants, with tiered pricing being the most opaque. Tiered pricing categorizes transactions into different levels or “buckets” based on the type of card and transaction details, affecting the rate charged to the merchant. This can lead to unpredictability in costs due to the various tiers, which may include qualified, mid-qualified, and non-qualified rates, each at increasing cost levels. In contrast, interchange-plus pricing offers greater transparency by applying a fixed markup over the interchange fee, and flat rate pricing simplifies this further by charging a consistent rate for all transactions. Dual pricing differs by involving the customer directly in the pricing strategy, offering price differences based on the payment method, which can result in more transparency and potentially beneficial outcomes for both merchants and customers.

Dual Pricing vs. Surcharging

Surcharging involves adding an extra fee to card transactions. This practice is regulated by card brands, which set specific guidelines and limits for the surcharge amounts. These regulations are intended to ensure transparency and fairness, preventing excessive fees that could deter card usage. While dual pricing offers an upfront choice between cash and card prices, surcharging adds a fee to the card price, directly impacting card-using customers.

Dual Pricing vs. Cash Discounting

Cash discounting and dual pricing strategies are often used interchangeably, though it’s important to note their application differs. Functionally, both approaches result in different prices for cash versus card payments, but the route to these outcomes varies. Cash discounting explicitly offers a lower price for cash transactions as an incentive, effectively a discount on the standard price. The key difference lies in the presentation and marketing cash discounting is framed positively as a discount for cash payers, whereas dual pricing straightforwardly lists two pricing options.

Evolution of dual pricing programs

Dual pricing strategies became prevalent in the 1970s, particularly in sectors like the petroleum industry. During this period, fluctuating oil prices and economic instability led to significant variations in operational costs for businesses. Many gas stations implemented this strategy to help them offset the higher transaction fees associated with credit card payments amidst the financial uncertainties of the time.

Merchant Benefits of Dual Pricing

Savings Potential

Dual pricing, also known as no-cost processing, offers significant savings potential for merchants.

- Reduced credit card fees: Merchants can save on credit card processing fees by offering a lower price to customers who pay with cash or debit cards.

- Increased sales: Offering dual pricing can incentivize customers to choose lower-cost payment methods, potentially leading to increased sales.

- Improved cash flow: By reducing credit card processing fees, merchants can improve their cash flow and have more money available for other business expenses.

- Competitive advantage: Offering dual pricing can give merchants a competitive advantage by attracting cost-conscious customers.

The savings from dual pricing depend on the volume of credit card processing and the effectiveness of marketing efforts. An effective dual pricing program can result in an average margin increase of 3-5%, which can translate into significant cost savings each year. For example, business xxx which participated in Tonic’s dual pricing program saved $$$ in processing fees.

Enhanced pricing flexibility

Dual pricing allows businesses to dynamically adjust their prices in response to market shifts, consumer demand, or competitive challenges. Merchants can test various pricing strategies and gather valuable data on consumer preferences. This flexibility ensures that companies can stay competitive by swiftly responding to market changes and maintaining their market position and adaptability.

Customer choice and transparency

Dual pricing empowers customers by giving them the option to select their preferred payment method based on cost. Customers who choose to pay with cash or debit cards benefit from lower prices, providing an immediate incentive to avoid credit card fees. This choice not only caters to cost-conscious customers but also enhances the shopping experience by making payment options more transparent and straightforward. The clear differentiation between cash and card prices can foster trust and loyalty, as customers appreciate the honesty and flexibility in pricing.

Transparency is a cornerstone of a successful dual pricing program. By clearly displaying both cash and card prices, merchants ensure that customers are fully informed before making a purchase decision. This openness helps in building trust and avoiding confusion or dissatisfaction at the point of sale. Proper signage and communication about the pricing structure, including the reasons behind the different prices, are essential. Educating customers about the savings they can achieve by choosing lower-cost payment methods reinforces the benefits of the dual pricing model and supports a positive customer relationship.

Legalities and Compliance

Our dual pricing program was designed to comply with the strictest laws, ensuring it meets the requirements of all states. This approach guarantees that our program adheres to local and state regulations, providing peace of mind and legal assurance.

Legal Disclaimer

This document and the information, opinions, or ideas contained herein are provided for informational purposes only and are not intended to be legal advice. Readers are advised that the concepts and practices discussed require further consultation with legal or professional advisors to ensure compliance with applicable laws and regulations.

Overview of legal requirements

Dual pricing programs must adhere to specific legal guidelines to ensure compliance. These guidelines vary by state, affecting how merchants implement and communicate their dual pricing strategies.

At the federal level, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 allows businesses to offer discounts for cash payments, provided they clearly communicate this to customers. This is intended to offset credit card processing fees without misleading consumers.

Merchants running a non-compliant dual pricing program may face significant penalties, including fines from card brands and potential state interference, depending on the laws in their jurisdiction. These penalties can be substantial and could impact their business operations. It’s crucial for merchants to adhere to all relevant regulations and card brand rules to avoid these consequences and ensure the smooth running of their dual pricing program.

State-Specific Regulations

In New Jersey, the law stipulates that any surcharge applied to credit card transactions cannot exceed the actual cost incurred by the merchant to process the payment (New Jersey P.L.2023 c.146, 2023). Merchants must also provide clear and conspicuous notices at the point of entry and sale, or on menus and checkout pages for online transactions.

New York law requires merchants to post the total price inclusive of any surcharges for credit card transactions (New York A2672-B, 2023). This ensures transparency and prevents merchants from charging more than the actual cost imposed by credit card companies. Merchants must clearly display both cash and card prices, ensuring customers are fully informed before completing a purchase.

In California, dual pricing is regulated under the California Civil Code Section 1748.1. This code allows merchants to offer discounts for cash payments as long as they clearly communicate the price differences to all customers. The law ensures that any additional fees for credit card payments are transparently disclosed. Compliance with these regulations is crucial for avoiding penalties and maintaining customer trust. For detailed legal information, you can refer to California Civil Code Section 1748.1.

Card brand regulations

Card brand regulations for dual pricing programs emphasize transparency and fairness. Visa and Mastercard allow dual pricing, provided merchants clearly disclose price differences at the point of sale, including entry points, registers, and online checkouts. Surcharges for card payments must not exceed the actual processing costs. Non-compliance may result in fines and disqualification from accepting these cards. Discover and American Express have similar requirements, emphasizing clear communication and fee limitations. Accurate transaction records and regular audits are essential to maintain compliance and avoid penalties.

Sticker pricing rules

In order to be fully compliant with card brand regulations, Tonic recommends that merchants clearly display both the card price (full retail price) and the cash discount price for every item sold. This ensures transparency and helps customers make informed payment decisions.

Display Requirements:

- Physical Signage: Prices must be clearly marked on shelves, menus, or product tags. Each item should show both the card price (full retail price) and the cash price distinctly.

- Digital Displays: For online transactions, both prices should be shown on the product page and during the checkout process.

- Point of Sale Notices: Notices should be posted at entry points, registers, and service areas to inform customers about the dual pricing structure.

In certain situations, it is not realistic to display both prices on menus or websites. While not ideal, in those limited situations, the full retail price (card price) must be displayed for customers. Of course, the other display requirements listed above must also still be followed. Using a dual pricing compliant system, like Tonic, will allow the cash discount price (lower price) to be calculated at the time of sale if the customer ends up paying with cash.

Taxing Regulations and Reconciliation

The taxation of dual pricing programs typically follows the same regulations as other pricing models, but there are a few key considerations to keep in mind:

Sales Tax Application: Sales tax is generally applied based on the final amount paid by the customer. Whether a customer pays the cash price or the higher card price, the sales tax is calculated on the amount they actually pay.

Disclosure Requirements: Proper signage and transparent communication about the dual pricing structure are crucial. This ensures compliance with consumer protection laws and avoids potential misunderstandings about the taxable amount.

Documentation:Maintaining clear and accurate records of transactions is essential. This includes differentiating between cash and card payments in your sales records to ensure accurate tax reporting.

State and Local Regulations:Tax regulations can vary by state and locality. It’s important to check with local tax authorities or a tax professional to ensure compliance with specific regional requirements related to dual pricing.

Tonic Dual Pricing Reporting

Reporting section will cover how tonic reconciles taxes and additional “income” so merchants can decipher and account for the additional 4% being collected.

Funding

In a dual pricing program, the funding process for merchant deposits remains unaffected by the different pricing for cash and card payments. For instance, if a merchant’s card rate is set to 4% higher than the cash rate:

- The customer’s credit card receipt will display the card rate for goods and services.

- On the following day, the total transaction amount, including the card payments, is deposited into the merchant’s bank account along with other transactions processed that day.

- The 4% difference charged to the customer is redirected to the processor, covering the processing fees instead of monthly charges.

This process ensures smooth and transparent funding for merchants while efficiently managing the cost of card transactions.

How to price a merchant application

Tonic partners looking to onboard a merchant application correctly in MxConnect under a dual pricing structure should contact our Partner Experience Team. They will provide guidance to ensure the rate entered on the application for processing payments matches the rate displayed at the point of sale for the card price. This ensures accuracy and compliance with the dual pricing model, helping you to effectively manage your merchant applications. The Partner Experience Team can be reached by calling 877-515-6464, option 2.

Understanding Receipts

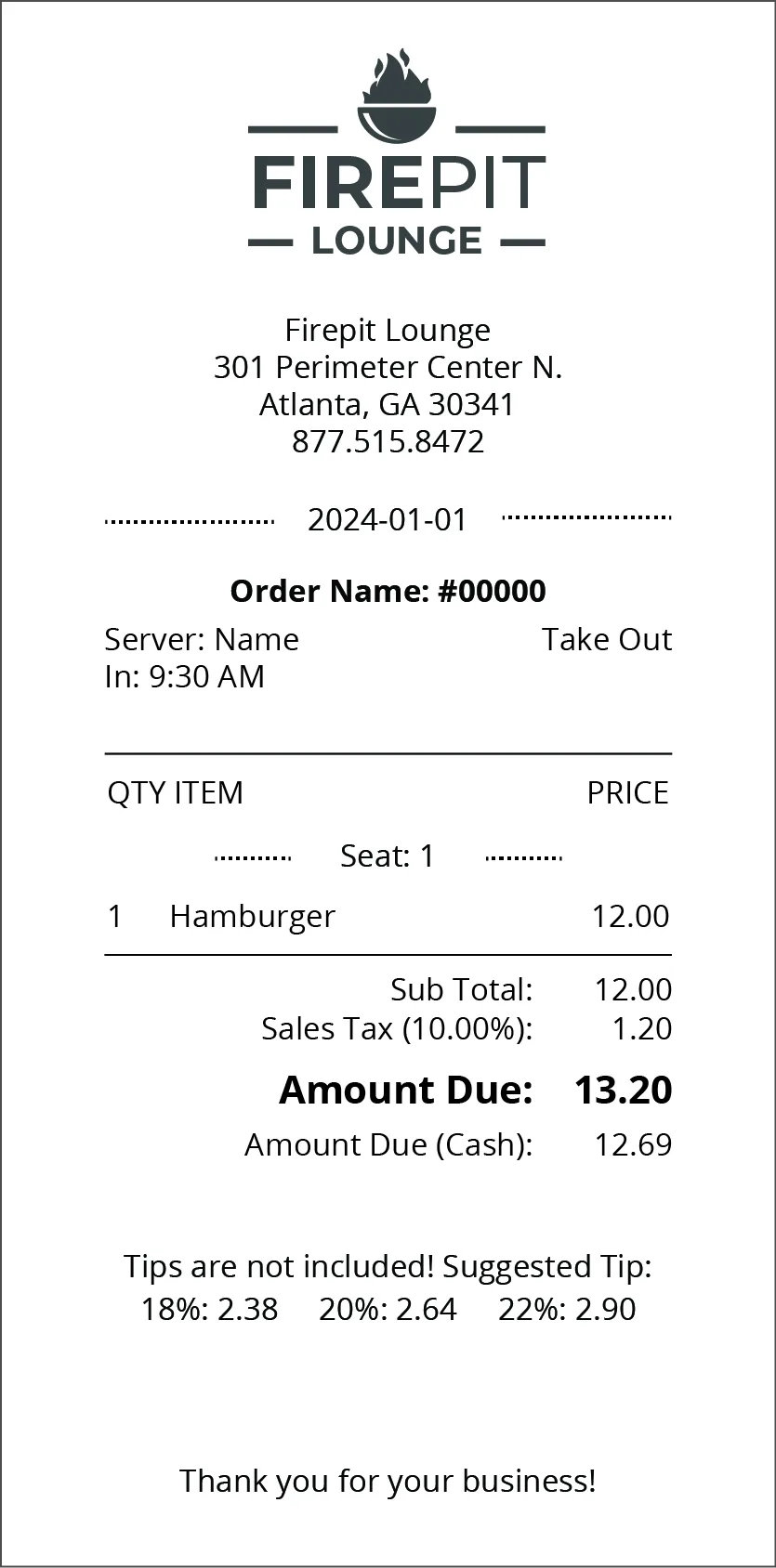

Importance of receipt clarity

Receipt clarity is crucial to ensure transparency and maintain a good customer relationship. A well-formatted receipt helps customers understand the pricing structure, reinforces trust, and ensures compliance with legal requirements.

Best practices for clear receipts

Business Information: Include the business name, address, contact information, and date of the transaction at the top of the receipt.

Itemized List: List each item or service purchased along with the quantity and price.

Dual Pricing Details: Display both the cash price and the card price for each item. In the sample receipt, the total amount due reflects the card price, while the cash price is also indicated.

Sales Tax: Show the sales tax amount separately to maintain transparency.

Total Amounts: Highlight the total amount due for card payments and the total cash price. This ensures customers see the difference based on their payment method.

Additional Charges and Tips: If applicable, include suggested tip amounts and space for the customer to add a tip.

Payment Method: Indicate the payment method used (e.g., card or cash) and ensure the receipt reflects the corresponding price.

Special Notices: Include any important notices, such as the dual pricing policy explanation or other relevant information.

Customer Signatures: Provide space for the customer’s signature, especially for larger transactions or those requiring authorization.

Digital Integration: Offer options for digital receipts, such as a QR code for payment or receipt access.

The sample receipt provided from Firepit Lounge follows these best practices by displaying both cash and card prices clearly. It lists the items purchased, applies the relevant sales tax, and highlights the total amounts for both payment methods. The inclusion of business information, transaction details, and a QR code for easy payment ensures a comprehensive and user-friendly receipt format.

Menu Set-up

Overview of menu setup requirements

A well-organized menu, whether physical or digital, enhances the customer experience by making pricing easily understandable. Compliance with local and state regulations is essential, and a correctly formatted menu helps avoid legal issues. Additionally, clear explanatory notes and consistent price formatting prevent confusion, leading to smoother transactions and increased customer satisfaction.

Menu Tips

Effective menu setup is essential for merchants implementing dual pricing programs. Many merchants have turned to menu boards to reduce the costs associated with frequent pricing updates. Menu boards offer a practical solution, allowing for quick and easy changes without the need for reprinting, ensuring that prices remain current.

Similarly, QR-based menus, which became popular during the COVID-19 pandemic, continue to be widely used due to their convenience and efficiency. These digital menus can be updated quickly and easily, making them a cost-effective and eco-friendly option. Customers can access the latest menu by simply scanning a QR code, eliminating the need for printed menus and reducing paper waste.

Physical Menu Requirements

- Clear Dual Pricing Display: Each menu item must display both the card price (full retail price) and the cash price (or, it that is not possible, then the full retail price (card price) must be displayed, and all the other display requirements must be followed, as stated in “Sticker Pricing Rules” above).

- Legibility: Prices must be legible and easy to read, using a font size and style that ensures visibility even in low-light conditions.

- Consistent Format: Maintain a consistent format for listing prices across the entire menu to avoid confusion. For example, list the card price (full retail price) first followed by the cash price.

- Regular Updates:Keep the menu updated to reflect any changes in prices or dual pricing policies. Ensure all staff are aware of these updates to avoid discrepancies.

Digital Menu Requirements

Digital menus provide flexibility, allowing merchants to rapidly respond to market changes or promotional needs. This adaptability not only saves on printing costs but also supports sustainability efforts by minimizing environmental impact.

- User-Friendly Layout: Use a clean, intuitive design to make it easy for customers to see and understand the dual pricing structure. Prices should be clearly differentiated and easy to read on various devices.

- Price Display: Ensure that both the card price (full retail price) and cash price are prominently displayed for each item on the digital menu (or, if that is not possible, then the full retail price (card price) must be displayed, and all the other display requirements must be followed, as stated in “Sticker Pricing Rules” above).

- Seamless Integration: Ensure the digital menu integrates smoothly with your ordering system, reflecting the correct prices at checkout and on digital receipts.

- Accessibility: Make sure the digital menu is accessible to all customers, including those with disabilities. Use alt text for images, ensure proper color contrast, and provide easy navigation.

Sample Dual Pricing Menu

Customer Communication Strategies

Merchant communication strategies to customers

Effective merchant communication strategies for a dual pricing program focus on clear signage and customer engagement. Merchants should prominently display notifications at points of sale and within the business premises to explain the cash and card payment price differences. This includes detailing the benefits of opting for cash payments. Such transparency helps maintain customer trust by highlighting the program’s aim to keep prices competitive and offset higher processing fees associated with card payments.

Educating merchants on the benefits of dual pricing

Educating merchants on the benefits of dual pricing is crucial for successful implementation and maximizing its potential. Understanding the cost-saving advantages, such as reduced credit card processing fees and improved cash flow, can motivate merchants to adopt this strategy. Additionally, awareness of how dual pricing can increase sales, attract cost-conscious customers, and provide a competitive edge helps merchants see the value in offering such options. Clear education fosters transparency, ensures compliance, and enhances customer trust, ultimately driving business growth and profitability.

FAQs ISVs and VARs Get from Merchants

- What is Dual Pricing?

Dual pricing allows merchants to offer different prices for the same product based on the payment method. Typically, there is a lower price for cash payments and a higher price for card payments.

- Is Dual Pricing Legal?

Yes, dual pricing is legal as long as it complies with state regulations and card brand rules. Clear disclosure to customers is required.

- How Do I Implement Dual Pricing?

Contact your Tonic POS partner, who will guide you through the easy setup process. Activation can be done with a few clicks in the Tonic back office.

- How Does Dual Pricing Benefit My Business?

Dual pricing can reduce credit card processing fees, improve cash flow, and attract cost-conscious customers, giving your business a competitive advantage.

- Will My Customers React Negatively to Dual Pricing?

Proper communication and transparency about the pricing structure and benefits of cash payments can help mitigate any negative reactions.

- How Are Taxes Handled in Dual Pricing?

Sales tax is applied based on the final amount paid by the customer, whether it’s the cash price or the card price.

- What Are the Compliance Requirements?

Compliance requirements vary from state to state. Review your state’s regulations as well as card brand rules to ensure you are fully compliant. Maintain clear and accurate transaction records, and conduct regular audits to address any discrepancies and uphold compliance standards.

- Can I Easily Switch Back to a Single Pricing Model?

Yes, Tonic POS allows for flexibility. You can adjust pricing models through the back office settings as needed.

How to Field Customer/Cardholder Questions

Equip your merchants with thorough knowledge about the dual pricing program. Ensure they understand the rationale, benefits, and legal compliance aspects to provide clear and accurate information to customers.

FAQ of customer/cardholder inquiries

- Why are you charging me more for using my card?

a. “The higher charge for card payments covers the processing fees charged by credit card companies. By offering a lower price for cash payments, we can manage these costs and keep prices competitive.”

- Is dual pricing legal?

a.”Yes, dual pricing is legal and complies with state regulations and card brand rules as long as it is clearly disclosed to customers.”

- Can I receive the cash discount if I start with a card payment and then switch to cash?

a. “Yes, if you initially choose to pay with a card but switch to cash before completing the transaction, you will receive the cash price.”

- How does dual pricing benefit me as a customer?

a. “Dual pricing benefits you by providing the option to save money through lower prices when paying with cash. This transparency allows you to make informed payment choices and potentially reduce your expenses.”

Training merchant staff on responding to questions and concerns

Train employees thoroughly on the dual pricing program so they can confidently explain the pricing structure, benefits, and any customer inquiries. Staff should be able to articulate why the program is in place—highlighting the aim to keep prices competitive by offsetting higher merchant processing fees.

Common pitfalls and how to avoid them

Poor communication

a. Failing to clearly communicate the dual pricing structure to customers can lead to confusion and dissatisfaction. Ensure prominent signage at registers and on menus.

Lack of Knowledge

a. Implementing dual pricing without fully understanding the legal and regulatory requirements can result in non-compliance and penalties. Educate yourself and your staff on state regulations, as well as card brand rules. We’ve already broken them down for you above!

Inconsistent Pricing Display

a. Not displaying both cash and card prices clearly and consistently can create customer mistrust. Always display both prices on all menus, product tags, and digital displays. The format should remain consistent and easy to understand.

Improper Receipt Formatting

a. Receipts that do not accurately reflect both cash and card prices, along with the total amount paid, can cause disputes. Design receipts to include all necessary information and use our receipt example as a guide.

Inadequate Staff Training

a. Staff who are not well-versed in the dual pricing program can provide incorrect information or fail to address customer concerns effectively. Provide thorough training to all employees on the policy, including its benefits and how to explain it to customers.

Implementation

Resources for Implementing Dual Pricing with Tonic POS

Tonic POS simplifies the implementation of dual pricing through an easy activation process in the Tonic back office. Merchants can enable this feature with just a few clicks. For detailed instructions on how to activate dual pricing, Tonic POS partners can refer to the comprehensive knowledge base article available at Dual Pricing Setup. This resource provides step-by-step guidance to ensure a smooth and efficient setup, making dual pricing accessible and hassle-free for all Tonic POS users.

General merchant implementation guidelines

- Understand Legal Requirements: Ensure your dual pricing program complies with state and federal regulations, as well as card brand rules. Consult legal advice if necessary.

- Transparent Communication: Clearly display both cash and card prices for all items. Use prominent signage at entry points, registers, and on menus (physical and digital).

- Staff Training: Train employees thoroughly on the dual pricing policy to ensure they can explain the pricing structure and benefits to customers accurately.

- Accurate Receipts: Ensure receipts clearly show both cash and card prices, the total amount paid, and any additional fees or discounts applied.

- Regular Maintenance: Regularly update all pricing information to reflect any changes and maintain compliance. This includes physical menu boards and digital menus.

- Customer Engagement: Proactively inform customers about the dual pricing program and its benefits. Use educational materials like brochures or online FAQs to provide clear explanations.

Appendix

References

- New Jersey P.L.2023 c.146. (2023). New Jersey Surcharge Law Synopsis. Retrieved from New Jersey Legislation.

- New York A2672-B (2023) Assembly Bill A2672B. Retrieved from New York Senate

- Visa Inc. (2024). Visa core rules and visa product and service rules. Retrieved from Visa Core Rules

- California Civil Code. Division 3 Obligations. Part 4 Obligations Arising from Particular Transactions. Title 1.3 Credit Cards Section 1748.1 (2023). Retrieved from California Legislative Information.

Glossary of Terms

Dual Pricing: A pricing strategy where merchants offer different prices for the same product based on the payment method, typically lower for cash payments and higher for card payments.

Flat Rate Pricing: A pricing model where merchants pay a consistent rate for all transactions, regardless of the underlying interchange fees.

Funding Process: The method by which transaction amounts are deposited into the merchant’s bank account, including the handling of additional fees charged to customers.

Interchange-Plus Pricing: A transparent pricing model where merchants are charged a fixed markup over the interchange fee set by credit card networks.

QR-Based Menus: Digital menus accessed by scanning a QR code, allowing for quick updates and reducing the need for printed menus.

State-Specific Regulations: Legal requirements that vary by state, affecting how dual pricing programs are implemented and communicated.

Surcharging: Adding an extra fee to card transactions to cover the cost of credit card processing fees.

Tiered Pricing: A pricing model that categorizes transactions into different levels or “buckets” based on card type and transaction details, with varying rates for each category.