Merchant Funding

DEPOSIT SCHEDULE

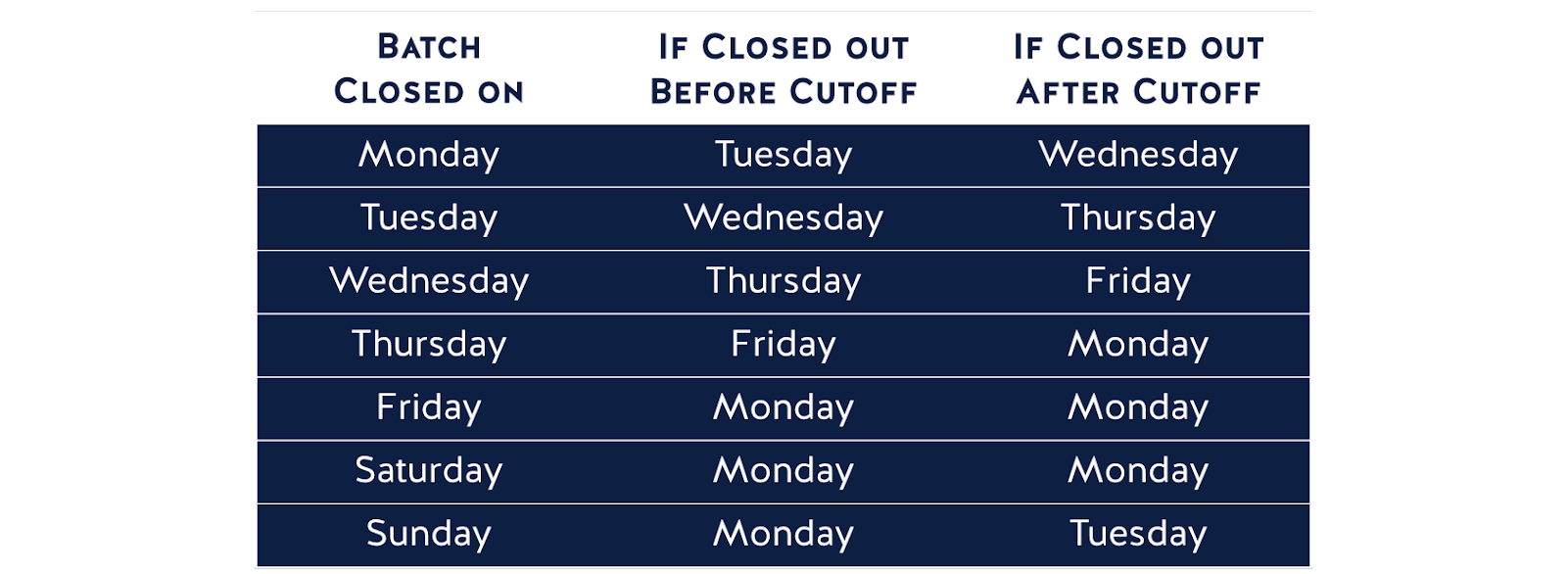

With VersiPay, next day funding (NDF) is standard. That means that if you batch out your daily sales before the cutoff time on Monday, the bank will process your batch that day, and the funds will be available in your bank account Tuesday morning. If the batch isn’t sent to the bank until after their cutoff time on Monday, then the batch wouldn’t get processed until Tuesday, and those funds would be available in your account on Wednesday morning.

Most banks don’t process deposits on the weekend, so batches submitted on Friday or Saturday will be processed by the bank on Monday morning and deposited that day.

As you can see, the batch submission cutoff time is an important factor in determining when you will receive your credit card deposit. Processor cutoff times vary, and generally correspond to the closing time of the bank. For the vast majority of hospitality businesses that operate into the evening hours, a batch submitted after you close for the night will have missed the NDF window and will be processed when the banks reopen on the next business day. If you are unsure of your business’ deposit cutoff time please reach out to our support team and we can help to make sure you know exactly when this cutoff occurs.

The chart below can help you identify when to expect your credit card deposits. Remember that if your batch is submitted after your cutoff time, the bank will consider it to have been submitted on the next business day. If your cutoff time is 4:00 PM on Monday and you close your batch at 4:05 PM, the bank will consider that batch to have been submitted on Tuesday.

GROSS VS NET DEPOSIT

Most businesses prefer to have all of their credit card sales deposited each day, with all the processing fees for that month deducted in a single debit at the beginning of the following month. This Gross deposit schedule is the default for most businesses; however, we also have a Net deposit schedule available for businesses that prefer to have processing fees deducted from each credit card batch. With a Net deposit schedule your processing fees will be calculated each day and deducted from that day’s batch automatically. Using a Net deposit schedule minimizes the processing debit at the beginning of the next month but can make accounting more difficult because your deposit won’t exactly match your daily credit card sales. There is no difference in the total fees accrued throughout the month, the only difference is whether those fees are deducted periodically throughout the month, or in one lump sum at the beginning of the following month. There is no right or wrong schedule.

CHARGEBACKS

Chargebacks are an unfortunate reality for many businesses, and while there are ways to reduce your risk of receiving them, it is impossible to eliminate that risk entirely. A chargeback can occur for several reasons, but generally, they happen when a customer reports to their payment card issuer that the product or service wasn’t fulfilled in some way, or that the charge was fraudulent. When a customer files one of these reports to their card issuer, the bank will initiate a chargeback claim, deducting those funds from your account and returning them to the customer. Once this chargeback process has started you have a short period of time to dispute the chargeback. In some cases, the window for you to respond may be only a couple of days, so if you intend to respond to a chargeback make sure you do so quickly. We are happy to assist you through this process and encourage you to reach out to us as soon as you have been notified that a chargeback has been initiated.

VersiTech is proud to offer an industry leading Chargeback Protection Program to reimburse you for most chargebacks. If you are enrolled in this program, we will automatically refund you for the most common chargebacks, without you having to respond to the chargeback at all. If you would like to find out more about our Chargeback Protection program, please let us know!

PROCESSOR ADJUSTMENTS

As much as we all wish that there were never any mistakes on the processing side, an additional unfortunate reality is that occasionally mistakes do happen. Processing systems are extremely reliable and thorough, but there can be errors that occur in billing. Processor adjustments are the result of some type of error that the processor is correcting to reflect accurate billing. These adjustments can be either a debit or a credit, decreasing or increasing the amount deposited into your bank account that day. Processor Adjustments are thankfully very rare, and most businesses will never see one.

DAILY SNAPSHOT REPORT

With VersiSync, you can now receive an email or text message each day with a summary of key business information like the previous days total sales, labor cost, average ticket size, and the total credit card deposit that will be deposited into your bank account that day. To calculate your expected deposit amount we use the total credit card payments reported by your POS and make the following assumptions:

- You have next-day funding, but missed the cutoff time. If you closed out your batch before the processor’s cutoff time, the ‘Today’s deposit’ section may show you the deposit that was made on the previous day.

- You are on a Gross deposit schedule. If your processing fees get deducted from your account each day rather than in one monthly lump sum, your actual deposit will be lower than the amount displayed on the Daily Snapshot report.

- There weren’t any Chargebacks or Processor Adjustments. Although these don’t occur often, if you notice that the amount deposited into your bank is less than what’s reported in the ‘Today’s Deposit’ section, there’s a good chance it is due to a chargeback or processor adjustment. If you think this has occurred, please let us know.

- It isn’t a holiday. Banks generally don’t make deposits on federal holidays. If the Daily Snapshot report shows that you should be receiving a deposit on a holiday, that deposit will be delayed until the banks reopen and will be deposited on the next business day.

We are working hard to improve our reporting capabilities and will have additional updates for you in the months to come. If you have feedback or suggestions for new reporting capabilities or anything else related to VersiTech products or services, please let us know by submitting a Feature Request.