Time is Money: How The Economy is Shaping Our Relationship with Digital Payments

In an era of rapid technological advancement, few sectors have undergone as much transformation as fintech. Digital payments and mobile wallets have moved from the periphery to the forefront of finance, fundamentally changing how we interact with money, convenience, and time.

The Rise of Digital Payments

For years, the conversation around digital payments focused on impending change. Today, that change is a reality. Consumer behavior has shifted from reluctance to acceptance and now to active participation. The reasons are clear: convenience and speed.

Time as a Currency

As a society, we’ve always valued time, but now more than ever. Time-saving conveniences are highly sought after because time has become a precious commodity. The surge in QR code payments, contactless transactions, and app-based purchases reflects this societal shift. We’re buying and selling moments, milliseconds that add up to valuable time.

Digital Payments: More Than Just Transactions

During a recent shopping trip, I encountered a QR code that unlocked a revelation. It wasn’t just a faster way to pay; it was an entry point to a richer consumer experience. Digital payment methods offer personalized offers, loyalty incentives, and valuable data for businesses. They’ve evolved from transactional utilities to relational assets.

Enhancing the Customer Experience

We often view digital payments in isolation, but they’re intricately linked to the overall customer experience. Payment methods are now tangible touchpoints between businesses and consumers. The efficiency of digital payments is matched by their ability to foster engagement, turning one-time interactions into long-term relationships.

The Future of Digital Payments

The rise of digital payments is tied to a broader shift in values. Convenience and time are the new currencies. Businesses and consumers are investing heavily in this new economy. We’re not just on the cusp of a revolution; we’re in the midst of it. This revolution will redefine how we perceive value, time, and money.

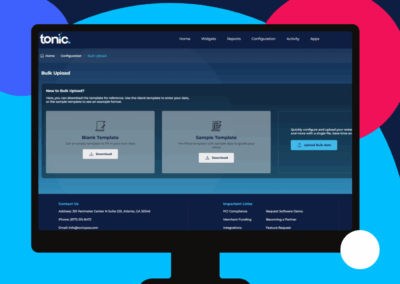

For years, business owners in the hospitality space have been between a rock and a hard place. The rock: impersonal, take-it-or-leave-it solutions provided by big name international startups who don’t understand local needs and love to fire local support and raise prices on a whim. The hard place: DIY software solutions that require loads of time, technical know-how and reliance on flakey, ad-hoc service providers. Now restaurants, bars, and venues no longer have to make that choice. With Tonic, you get an industry-leading product created by a team of restaurateurs and the best software engineers in the business. But unlike other services whose support stops at the plug, with Tonic you’ll have a dedicated local partner who knows how to make the tech work for your neck of the woods. That means solutions, consultation, maintenance and repair are all handled by a professional and not farmed out to a call center half-a-world away.