The landscape of consumer transactions is witnessing a seismic shift, primarily driven by the rising demand for digital and contactless payment options. This trend, underscored by Shell’s recent integration of Apple Pay and Google Pay, signifies a broader move toward convenience and security across industries. As one of the world’s leading energy suppliers, Shell’s adaptation to these payment methods marks a significant milestone in the commercial sector, setting a precedent for other businesses to follow.

The Impact on the Restaurant Industry

In the face of these evolving consumer expectations, the restaurant industry, in particular, stands at a crossroads. Establishments now face the pressing need to modernize their transaction processes to keep pace with the changing times. This evolution in payment preferences is not just about keeping up with technological advancements; it’s about redefining the dining experience for customers. They seek the same ease and safety in payment options they enjoy in their everyday retail transactions, such as fueling their vehicles.

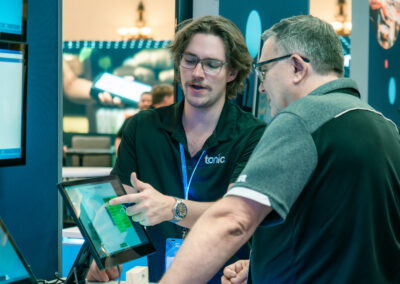

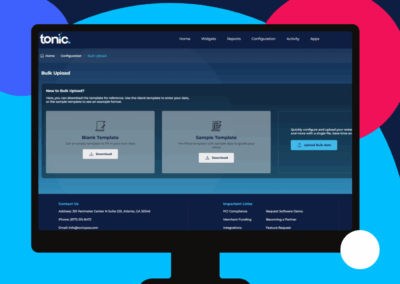

Enter the modern point-of-sale (POS) systems, demonstrated by platforms like Tonic. Such systems embody the shift toward a more integrated, customer-centric approach in the hospitality sector. These advanced POS solutions cater to the growing demand for efficient, secure transaction methods, mirroring the changes seen in establishments like Shell.

Tyler Young, CEO and founder of Tonic, highlights this major change: “Historically, accepting contactless payments was an extra expense for merchants. Today, the high demand makes it a standard expectation.” This observation stresses the critical transition from traditional payment methods to a digital-first approach, emphasizing the necessity for businesses to adapt or risk falling behind.

The Broader Implications of Digital Payments

The transition to digital payments extends beyond mere convenience. It reflects a deeper change in consumer behavior and market dynamics. The adoption of these technologies speaks to a growing awareness around security, reducing the physical exchange of cash or cards, thereby limiting potential fraud and contamination risks — a concern that has become increasingly prominent in recent years.

Embracing the Future of Payments

Embracing digital payment methods is a crucial step forward for any business, especially in the hospitality sector. By integrating solutions like Tonic into your operations, you’re not just keeping up with the times; you’re enhancing your customer service and preparing for the future. Take the leap and revolutionize your customer experience with smart, secure payment solutions.